Let’s be honest. You’re a leader in a major bank, and the board is buzzing about Generative AI. Your competitors are issuing press releases. Your inbox is flooded with vendors promising digital nirvana. You feel the pressure to do something, but the risk of a multi-million dollar misstep feels terrifyingly real.

It’s like being handed the keys to a fleet of futuristic bulldozers and told to "innovate" your city. Where do you even start digging? Do you level the glamorous skyscrapers on Wall Street or start with the creaking infrastructure no one sees? A wrong move could be catastrophic.

What you need isn't more hype. You need a map. A data-driven, quantifiable, and—dare we say—sensible blueprint for deploying GenAI. This isn't about random acts of AI or playing "buzzword bingo." This is about a strategic, risk-managed approach to unlocking real value.

So, let's build that map.

Mapping the Concrete Jungle: Your Bank’s Real AI Attack Surface

First, let's acknowledge the beast. Your universal bank isn't a single entity; it's a sprawling, complex ecosystem. You have four distinct businesses under one roof:

- Retail Banking: The public face, dealing with millions of customers and transactions.

- Corporate Banking: The high-stakes world of financing the world's largest companies.

- Investment Banking: The hyper-specialized domain of M&A and capital markets.

- Wealth Management: The high-touch, bespoke service for the ultra-wealthy.

This complexity creates a data nightmare. Information about a single corporate client is likely scattered across a dozen different systems that don't talk to each other. This is the "convergence-complexity nexus," and it’s both your biggest headache and your single greatest opportunity.

Now, let's slice this city another way:

- The Front Office: The glamorous storefronts and trading floors. This is where the rain is made.

- The Back Office: The sprawling, unseen engine room—payments, settlements, IT—that keeps the city’s lights on. It’s a massive cost center.

- The Middle Office: The city's planners and police force—risk, compliance, financial control—trying to make sure the rainmakers don't accidentally bulldoze city hall.

The seductive narrative is to aim AI at the flashy front office. But the data tells a different story. The greatest, safest, and fastest ROI is often found in the operational engine room—the middle and back offices, where high-volume, repetitive, and document-heavy processes are begging for an upgrade.

Finding the Paper Mountains: The Real Work of the Bank

If you peel back the label on any core banking process, what do you find? Documents. Mountains and mountains of them.

- Originating a Mortgage? It's a 45-day paper chase of tax returns, pay stubs, appraisals, and legal disclosures.

- Onboarding a New Corporate Client? It’s a compliance-driven deep-dive into articles of incorporation, ownership charts, and endless adverse media reports to satisfy Know Your Customer (KYC) rules.

- Executing an M&A Deal? Your team lives in a virtual data room drowning in confidential memos, due diligence reports, and thousand-page legal agreements.

This is the common thread. Your bank doesn’t run on money; it runs on the information contained in unstructured documents.

Traditional automation (RPA) chokes on this stuff. It needs neat, clean, structured data. But GenAI? It reads contracts, emails, and reports like a human—only it can read a million documents before you've finished your morning coffee. This is why GenAI isn't just another IT upgrade; it's a fundamental game-changer for how work gets done.

The “GenAI Prize Score”: A Quantifiable Test for Every Idea 🏆

So, how do you separate the game-changing ideas from the career-changing disasters? You need a scoring system. I call it the GenAI Suitability Score (GSS)—a weighted model that provides a single, comparable number for any potential project. Think of it as an "AI-Q" test for your business processes.

It’s based on five simple questions, but the weighting is everything:

- Data Input Nature (20% Weight): Does this job involve reading messy, unstructured human stuff (like contracts or call transcripts)? High Score. GenAI loves messy.

- Process Repetitiveness (15% Weight): Is this task a mind-numbing Groundhog Day? High Score. Automation finds its biggest wins in boring, high-volume work.

- Decision Complexity (25% Weight): Does this require a gut feeling, a strategic leap, or signing your name on a billion-dollar check? Low Score. We're looking for AI to "find and summarize," not "bet the bank."

- Regulatory & Compliance Scrutiny (25% Weight): Is the regulator breathing down your neck on this specific process? Low Score. You don't send the rookie AI into a legal minefield on its first day.

- Impact of Error (15% Weight): If the AI messes up, is it a "whoops, typo" or a "whoops, we just sent $100M to the wrong account"? Low score for catastrophic "whoopsies."

Notice something critical? We put 50% of the total score on risk and complexity (Criteria 3 & 4). This framework is intentionally conservative. It’s designed as a risk management tool first and an opportunity-finder second. It forces you to prioritize projects that are not just valuable but, more importantly, safe.

The GenAI Heatmap: Your Treasure Map to Quick Wins and Red Zones

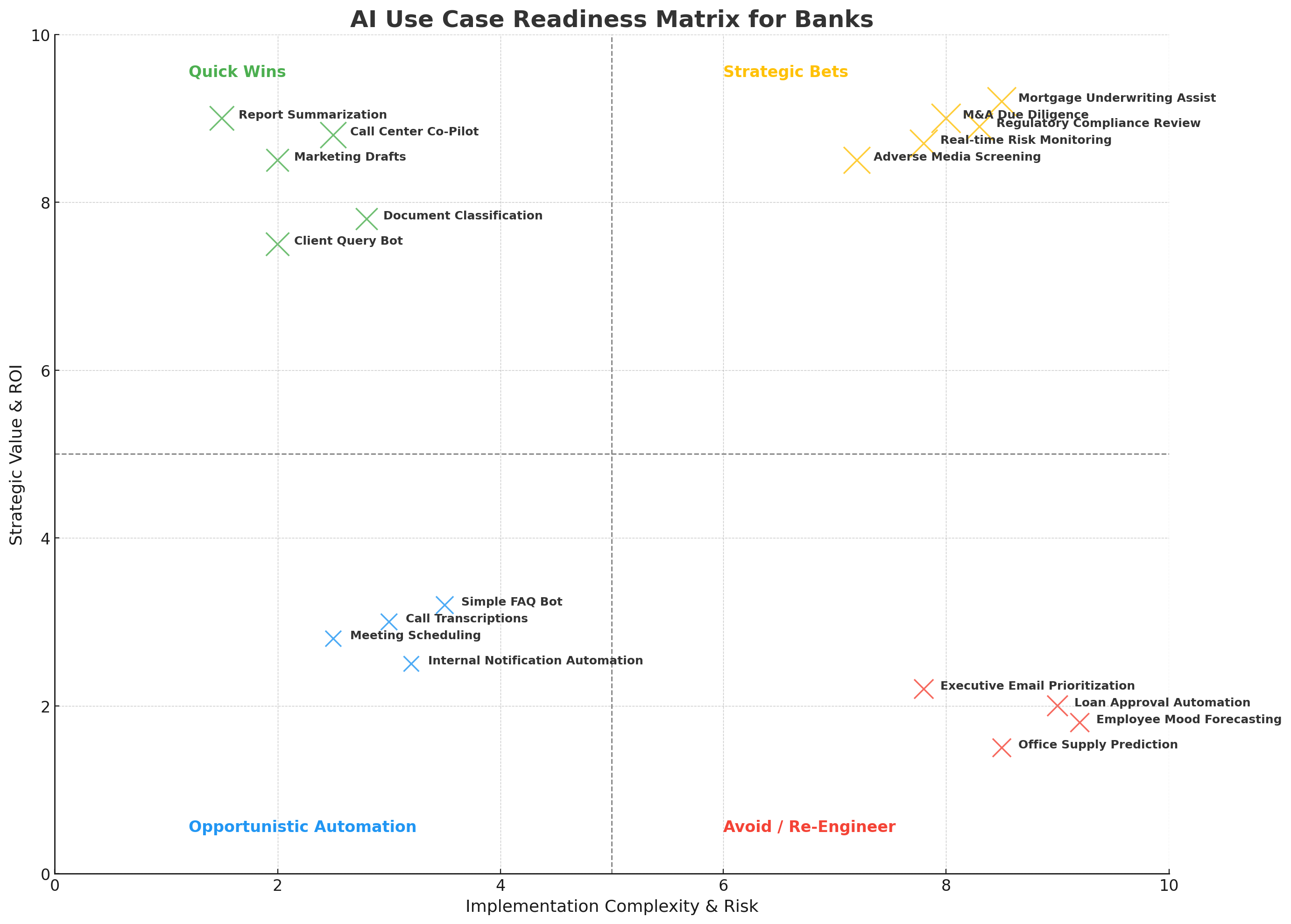

When you apply the GSS framework across your bank, a clear picture emerges. This heatmap provides precise guidance on where to uncover AI opportunities and identify potential risks.

🔥 The Green Zones: Go Now! (High GSS Scores)

These are the low-risk, high-reward opportunities you can start on today.

- The Internal Genius (GSS: 4.85): Turn your chaotic internal knowledge—research reports, policy documents, training manuals—into a searchable, all-knowing oracle for your team. Morgan Stanley armed 16,000 financial advisors with a tool that queries 100,000+ documents. One study found this boosts analyst productivity by 27% and helps them consume 60% more information. This isn't just an efficiency gain; it's an effectiveness multiplier.

- The Agent's Super-Sidekick (GSS: 3.95): Provide your call center agents with a co-pilot that listens to calls in real-time, discreetly offers the correct responses, and automatically generates call summaries. The result? Lower handle times, happier customers, and less agent burnout.

- The Initial Document Sorter (GSS: 4.05): In that 45-day mortgage process, don't have a human spend hours just identifying and extracting data from W-2s and bank statements. Let an AI do the initial classification and data entry in seconds.

- The Tech Accelerator (GSS: 3.85): Your developers are a precious resource. Let GenAI help them generate code, write tests, and translate ancient COBOL systems into modern languages. This accelerates time-to-market for every new digital product you want to launch.

🛑 The Red Zones: Danger! Here Be Dragons! (Low GSS Scores)

The framework also strongly advises against certain ideas by screaming "STOP!" Currently, GenAI is simply not prepared for these scenarios, and any vendor claiming otherwise is offering false hope.

- Autonomous High-Value Decision Making (GSS: 2.15): Do NOT let an AI autonomously approve a $500 million corporate loan. The nuance, judgment, and accountability required are profoundly human.

- Unsupervised Financial Advice (GSS: 2.00): Letting an AI give binding, unsupervised investment advice to a wealth management client is a recipe for epic lawsuits and regulatory nightmares.

- Autonomous High-Value Payments (GSS: 2.85): While payment processing is rule-based, the "Impact of Error" score is a 1 (Catastrophic). The risk of an irreversible, multi-million-dollar mistake from a probabilistic system is unacceptable.

The strategy is clear: it's a barbell. Hit the high-value, low-risk opportunities on the ends of the spectrum (internal knowledge synthesis and tech acceleration). Avoid the complex, high-stakes middle ground... for now.

The ‘SAFER’ Sanity Check: Your Final Go/No-Go

Once you’ve identified a "Green Zone" project, run it through one last qualitative filter before you write the check. The SAFER framework is your final, common-sense sanity check.

- S - Suitability: Is this assignment truly a job for GenAI, or are you just using a sledgehammer to crack a nut?

- A - Accuracy & Accountability: What level of accuracy is good enough? And more importantly, who is the human accountable for the AI's output?

- F - Feasibility: Do you actually have the data, the tech infrastructure, and the wizards to pull the project off?

- E - Ethics & Enterprise Risk: Have you talked to your risk, compliance, and legal teams before building, not after?

- R - Return on Investment: How will this project make money, save money, or reduce risk? Show me the KPIs.

If you receive a "No" on any of these, please pause. Until we resolve that critical blocker, we cannot proceed with the project.

Your Real Secret Weapon: The Human-in-the-Loop

After all this analysis, one conclusion is overwhelming: for the foreseeable future, the winning model in banking is not full automation. It's human-AI collaboration.

Think of GenAI as the most brilliant, tireless junior analyst you've ever hired.

It is capable of reading 10,000 pages of due diligence before lunch, drafting a personalized client email in seconds, and pinpointing the precise risk within a vast amount of data. But your human expert remains the senior partner. They provide the strategic context, apply nuanced judgment, verify the critical facts, and hold ultimate accountability for the final decision.

The AI revolution in banking isn't about replacing your best people. It's about empowering them with enhanced capabilities.

The frameworks are here. The data is waiting in your systems. The high-value, low-risk opportunities are now clearly mapped. The question is no longer "what if," but "what's next?"

Let’s build the map for your bank together.