The Introduction

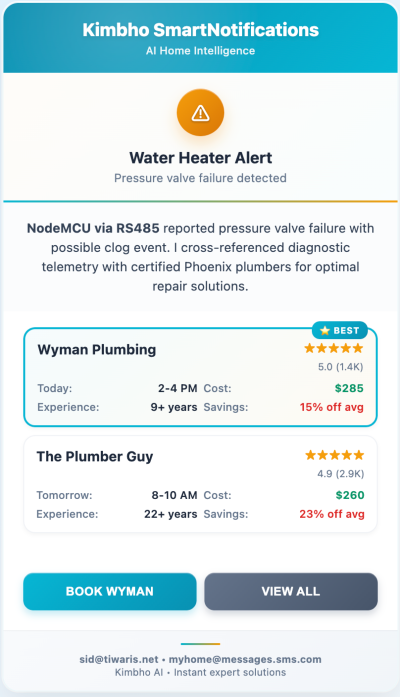

The notification wasn't an alert; it was a solution. It arrived silently on a Tuesday morning, not from a news app, but from the home’s central AI. "The smart water heater is reporting a pressure valve failure. I have cross-referenced its diagnostic data with three local, 5-star-rated plumbers who are certified for this model. Plumber B can arrive between 2 and 4 PM today for a total repair cost of $285, which is 15% below the regional average. Plumber C is available tomorrow morning for $260. Shall I book Plumber B to resolve the problem today?"

There was no frantic searching, no calling for quotes, and no comparing reviews. There was only a single, high-level decision to make. The internet is the future of commerce, and it has very little to do with a shopping cart.

The "Buy It Now" button has defined the digital economy for the last two decades. E-commerce trained us to be ruthlessly efficient task managers—to find the right product, compare prices, and click to purchase. We got faster at doing the work. But a fundamental shift is underway, powered by autonomous AI agents. We are now entering the era of "Do It Now." This new paradigm isn't about helping you do the task faster; it's about delegating the entire outcome.

Agentic Commerce: an ecosystem where you state a goal, and an intelligent agent plans, negotiates, and executes the complex steps required to achieve it. This is not an incremental update. It is a full-scale economic and technological shift that will rewrite the rules of digital interaction and redefine value for every participant in the global marketplace. From the tech giants building the agents to the payment networks securing the transactions, from the global banks funding the purchases to the local merchants fulfilling the orders—no one will be untouched.

This guide is designed to be a strategic map for this new territory. We will dissect the architecture of this autonomous economy, introduce the critical concept of the "Agent Wallet," and analyze the specific threats and once-in-a-generation opportunities for every major stakeholder. Finally, we will confront the systemic risks and chart a path forward for building a trusted, efficient, and equitable agent-driven world.

What is Agentic Commerce? The Architecture of Autonomy

To grasp the scale of the "Do It Now" economy, we must first understand its engine. Agentic Commerce is built on a powerful synergy of three advancing technologies:

- Large Language Models (LLMs): Think of an LLM as the cognitive engine or the brain. These models (like those powering ChatGPT, Gemini, and others) are trained on vast amounts of information, giving them a sophisticated understanding of human language, context, and the ability to reason, plan, and break down complex problems into smaller steps.

- AI Agents: If the LLM is the brain, the AI agent is the body. It is the software construct that gives the LLM the ability to act. An agent can be equipped with "tools"—the ability to browse the web, use an application's API, access a database, or execute code. It is the vehicle for carrying out the LLM's plan in the real world.

- Agentic AI: This approach is the synthesis of the two. It's an autonomous system that can pursue a complex, multi-step goal with minimal human intervention. It doesn't just answer a question; it takes the answer and does something with it, learning and adapting as it goes.

This combination fundamentally changes the digital workflow from a user-led process to an agent-led one.

The "Goal-to-Execution" Model

The e-commerce model we have mastered is a linear path where the user performs every action: you search for a product, you scroll through results, you compare options, you add to a cart, and you check out.

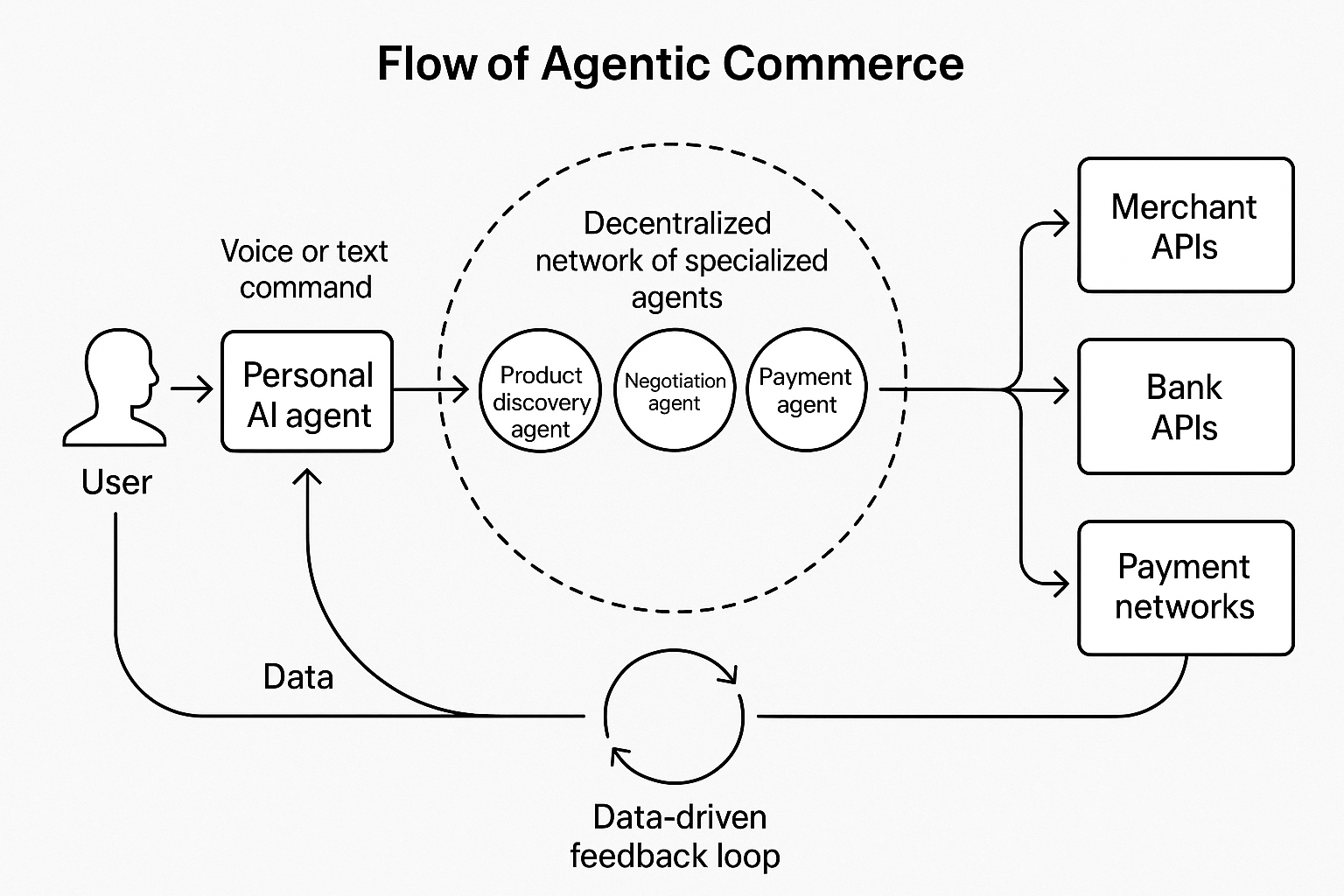

Agentic Commerce introduces a cyclical "Goal-to-Execution" model:

- Goal: The user states a high-level objective. "I need to host a dinner party for six people on Saturday night. Plan a three-course Italian meal, order all the ingredients to be delivered by Friday, and find a Chianti that pairs well with it, all within a $200 budget."

- Deconstruction & Planning: The user's Personal Agent (powered by an LLM) breaks the goal down into a series of tasks: create a menu, generate a shopping list, find grocery delivery services, search wine retailers, compare prices, check delivery slots, and verify the total against the budget.

- Execution: The agent then uses its tools to execute these tasks. It might query a recipe API, interact with the APIs of Instacart and DoorDash, check reviews on Vivino, and access the user's Agent Wallet to confirm budget constraints.

- Outcome & Approval: The agent presents a completed plan for a single point of approval. "I have planned a menu of Caprese salad, lasagna, and tiramisu. The ingredients from Safeway will cost $112 and can be delivered Friday at 4 PM. I have found a 92-point rated Chianti Classico for $28. The total cost is $140. Shall I proceed with the orders?"

The user's role has shifted from being the worker to being the director.

The Agent Wallet: The Financial Heart of the New Economy

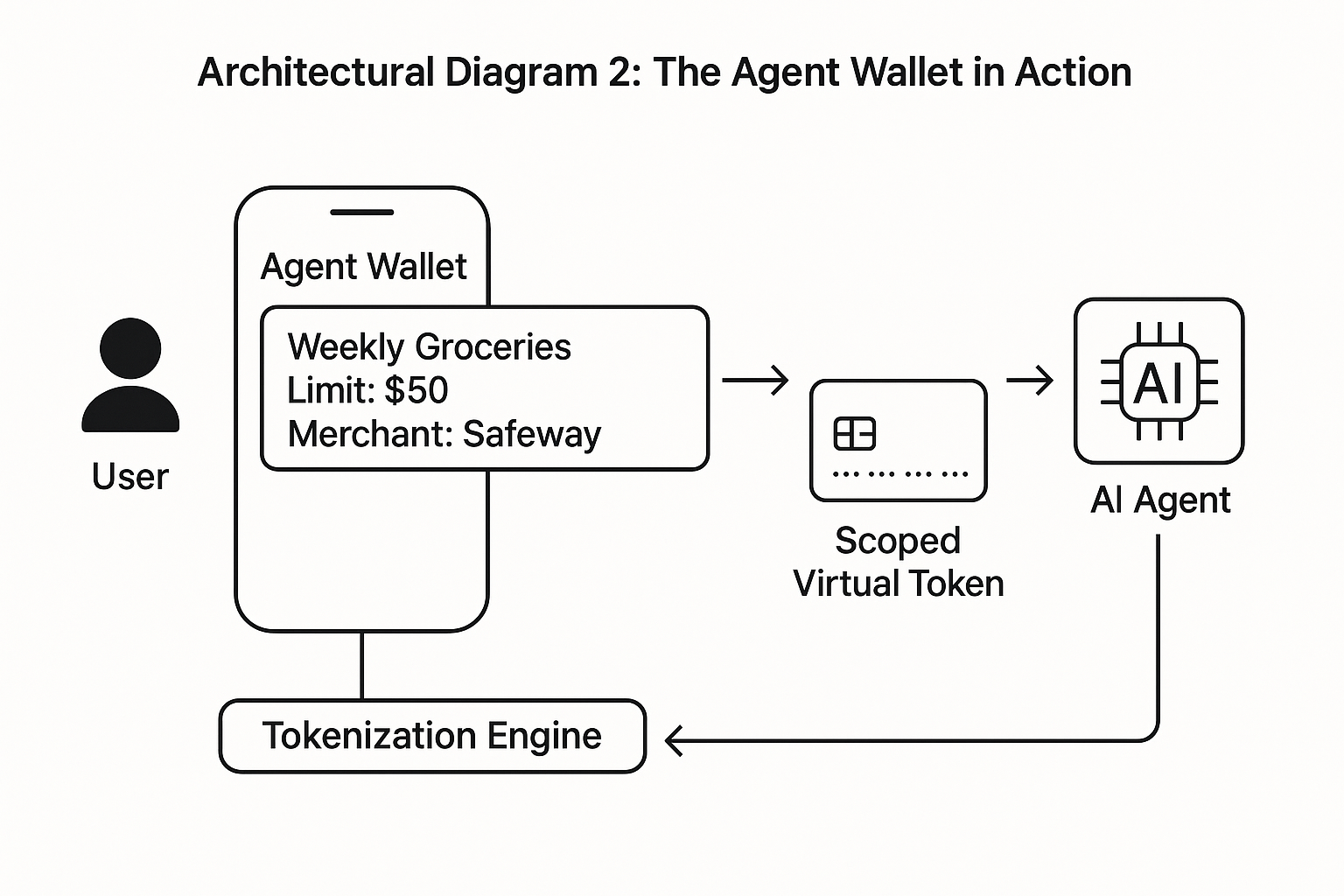

The rise of autonomous agents exposes a fundamental flaw in our current digital payment infrastructure: it was built for humans, by humans. The simple act of storing a credit card number in a browser or a basic digital wallet is woefully inadequate for a world where software can make financial decisions. Giving an AI agent direct, unfettered access to your primary financial accounts is a potential security risk. To unlock the potential of the "Do It Now" economy, we need a new financial primitive—one designed for delegation, security, and control.

Enter the Agent Wallet.

The Agent Wallet is not merely a place to store value; it is a programmable layer to securely delegate purchasing power. Think of it less like a physical wallet and more like a sophisticated financial command center. It allows a user to grant their AI agents specific, scoped, and revocable permissions to transact on their behalf, without ever handing over the keys to their core accounts.

Its architecture is defined by four critical characteristics:

- Programmable Permissions: The user remains the director, setting clear and granular rules for their agents. These are not simple on/off switches but dynamic controls. For example, a user could configure their wallet with rules like

- Budget-Based: "Allocate a maximum of $300 to my 'Weekend Trip' agent."

- Category-Based: "My 'Home Maintenance' agent is only authorized to spend at hardware stores and with certified service providers."

- Time-Based: "My 'Subscription Manager' agent can only initiate renewals between the 25th and 30th of each month."

- Delegated Authority via Tokenization: The Agent Wallet's security linchpin is that it never shares raw financial credentials. When a user grants a permission, the wallet leverages tokenization technology to generate a temporary, single-purpose, or scoped virtual payment credential. The AI agent receives only this secure token, which is useless outside of its narrowly defined context (e.g., for one specific merchant, for one transaction, or under a certain dollar amount). In the event of a token compromise, the user's primary account maintains complete security.

- Non-Custodial by Design: To build lasting trust, users must always feel in control. The most secure agent wallets will be non-custodial, meaning the user—and only the user—holds the cryptographic keys to their underlying funds. The wallet provider facilitates the creation of rules and tokens, but they cannot access or move the user's assets, creating a powerful barrier against both external attacks and internal misuse.

- Auditable and Instantly Revocable: Control requires transparency. Every action taken by an agent using delegated authority must be logged in a clear, human-readable audit trail. The user must be able to see exactly what was spent, where, when, and for what purpose. Most importantly, every permission must be instantly revocable. If a user becomes uncomfortable or an agent behaves unexpectedly, they must have a "master switch" to immediately revoke all delegated tokens and freeze all agent activity.

The Stakeholder Matrix: Threats, Opportunities, and Strategic Imperatives

The transition to an agent-driven economy is not a uniform tide that will lift all boats equally. It will create clear winners and losers based on how proactively each sector adapts. Understanding your specific position—your unique threats, opportunities, and necessary actions—is the first step toward navigating the disruption.

A. For Tech Giants (The Amazons, Googles, Apples): The Battle for the "Prime Agent"

The world's largest tech companies are in a pole position to dominate the agentic landscape. They control the primary user interfaces—the operating systems, browsers, and smart speakers—through which most users will first interact with an AI agent.

- The Opportunity: The ultimate prize is to become the user's "Prime Agent"—the default, top-level AI assistant that orchestrates all other specialized agents. Owning this relationship means controlling the gateway to all commerce, gathering unparalleled data on user intent, and creating an ecosystem lock-in far more powerful than any app store. An Apple agent embedded in iOS, a Google agent built into search and Android, or an Amazon agent powering Alexa could become the de facto operating system for a user's life.

- The Threat: The primary threat is to each other. This is a zero-sum game for the top spot. If a user's life is primarily run by their Google agent, it diminishes the power of Apple's and Amazon's ecosystems, and vice versa. The company that loses the race for the Prime Agent risks being relegated to a "specialized tool" that the winning agent simply calls upon.

- Strategic Imperatives:

- Integrate Deeply: Seamlessly embed agentic capabilities into core products (OS, search, browser, hardware). The less friction, the more likely it is to become the default.

- Build a Trusted Framework: Leverage existing user trust in the brand to position the agent as a secure and private life manager.

- Foster an Open Ecosystem (Strategically): While the goal is to be the prime agent, they must allow third-party specialized agents and services to plug in. A closed ecosystem will be rejected by users who want the best tool for the job, not just the tool you own.

B. For Financial Institutions (The Chases, HSBCs): From Rail Provider to Trust Provider

For decades, banks have been the bedrock of commerce, but often as an invisible utility. Agentic commerce presents an opportunity to move from the background to the foreground.

- The Opportunity: Banks are one of the most trusted institutions in a consumer's financial life. Their greatest opportunity is to leverage this trust to become the premier provider of the Agent Wallet. By offering a bank-branded, secure wallet, they can become the central hub for their customers' delegated financial lives, gaining deep insights into spending patterns and offering hyper-personalized loans, insurance, and investment products at the exact moment of need.

- The Threat: Disintermediation. If banks fail to act, the Agent Wallet will be owned by the tech giants. In this scenario, the bank is relegated to a "dumb pipe," a commoditized back-end service that the Apple or Google Agent Wallet simply pulls funds from. The customer relationship, the data, and the opportunity for value-added services all shift to the tech company.

- Strategic Imperatives:

- Embrace "Banking as a Service" (BaaS): Develop robust APIs that allow their services to be easily and securely integrated into the agentic ecosystem.

- Launch a Defensive Wallet Strategy: Aggressively develop and market a proprietary, secure Agent Wallet that puts customer control and trust at the forefront.

- Invest in AI-Powered Security: Redefine fraud detection for an era of non-human actors, using AI to monitor agent behavior and predict malicious activity.

C. For Payment Networks (The Visas, Mastercards): The Orchestration Layer

Payment networks sit at the intersection of banks, merchants, and consumers. This unique position makes them the natural candidate to become the central nervous system of agentic commerce.

- The Opportunity: To become the universal Orchestration Layer. Networks can establish the technical standards, security protocols, and communication rules that allow all agents, wallets, and merchants to interact seamlessly and securely. This includes creating a universal "agent identity" framework and providing the tokenization services that underpin the Agent Wallet.

- The Threat: Irrelevance through fragmentation. If major tech companies build their own closed-loop payment ecosystems for their agents (e.g., an "Apple Agent Pay" that only works within Apple's sphere), it could bypass the traditional networks entirely, eroding their transaction volume and central role.

- Strategic Imperatives:

- Champion Standardization: Drive the creation of universal protocols for agent-initiated payments, similar to the EMV standard for chip cards.

- Scale Scoped Tokenization-as-a-Service: Become the leading provider of the tokenization services essential for secure delegation in Agent Wallets.

- Build a Certification Authority: Establish "Agent-Ready" certification programs for merchants and wallet providers to create a universally trusted ecosystem.

D. For Acquirers & Processors (The Stripes, Adyens): The Developer's Bridge

These nimble, tech-forward players are the crucial link between legacy banking infrastructure and the modern digital world.

- The Opportunity: To be the essential Developer's Bridge. Agent developers and merchants will need simple, powerful tools to connect to the agentic economy. Acquirers can provide the APIs, SDKs, and developer platforms that make it easy to accept agent-initiated payments, provision virtual cards, and integrate with multiple Agent Wallets.

- The Threat: Commoditization. Larger players could potentially squeeze their value if they only offer basic payment processing services. The acquirer's role may diminish if a Mastercard Orchestration Layer or a bank's Agent Wallet provides its own direct integration tools.

- Strategic Imperatives:

- Focus on the Developer Experience: Create the simplest, most powerful, and best-documented tools for building agentic commerce applications.

- Aggregate and Simplify: Act as a universal adapter, allowing a merchant to accept payments from any agent wallet through a single integration.

- Innovate on Value-Added Services: Offer specialized services like advanced agent fraud detection, multi-currency agent settlement, and compliance-as-a-service.

E. For Merchants (From Walmart to the Local Coffee Shop): "Product Truth" Over Brand Marketing

For merchants, agentic commerce represents the most profound shift in customer acquisition and relationship management in history.

- The Opportunity: A more level playing field. Agents will make decisions based on data: price, user reviews, availability, delivery speed, and specifications. This allows smaller merchants with superior products or services to compete directly with larger players who have historically dominated through massive marketing budgets. The focus shifts from shouting the loudest to having the best, most verifiable "Product Truth."

- The Threat: Brand disintermediation and margin compression. The agent is the new customer interface. Brand loyalty becomes secondary to the agent's recommendation. An agent's ability to instantly compare every option for a given product will create radical price transparency, putting immense pressure on margins.

- Strategic Imperatives:

- Master Structured Data: Ensure product information is available in a clean, structured, machine-readable format. If an agent can't parse your inventory, pricing, and specifications, you are invisible.

- Invest in API-First Commerce: Your API will become your most important storefront. It must be robust, reliable, and easy for agents to interact with.

- Differentiate Beyond Price: Since agents will optimize for price, merchants must compete on other data-driven factors: demonstrable quality, consistently high user ratings, unique features, and guaranteed delivery speed.

Navigating the Uncharted Territory: Systemic Risks & The Path Forward

The promise of a seamless, automated world run by intelligent agents is immense, but so are the potential pitfalls. Building this future responsibly requires a clear-eyed assessment of the systemic risks involved and a collaborative commitment to erecting guardrails. No single stakeholder can monopolize the challenges; they are ecosystem-wide issues that necessitate ecosystem-wide solutions.

The Systemic Risks of an Agent-Driven World

Three major categories of risk loom over the agentic commerce landscape:

1. Security & Fraud: The Crisis of Digital Trust When software can spend money, the nature of fraud evolves. The main challenge is proving that an agent is who it claims to be and that it is acting within its owner's authority.

- Agent Spoofing & Impersonation: Malicious actors could create fraudulent agents that impersonate legitimate ones to trick users into delegating authority, or they could find ways to hijack the communication between a user and their agent.

- Automated Fraud at Scale: A compromised agent could be programmed to execute thousands of fraudulent micro-transactions in seconds, far faster than human-centric fraud detection systems can react.

- The Need for Cryptographic Proof: The ecosystem will require a new security standard beyond simple passwords or API keys. The solution will probably use cryptographic proof-of-delegation, which means that every action taken by an agent will have a unique digital signature that verifies who they are and what permissions the user has given them.

2. Economic Disruption: The End of Predictable Commerce The hyper-efficiency of agentic commerce will create profound economic shifts, threatening established business models and revenue streams.

- Radical Brand Disintermediation: Agents will act as rational, data-driven intermediaries. A brand's multi-million dollar advertising campaign will mean little to an agent tasked with finding the objectively best product at the lowest price. This severs the direct relationship between brands and consumers, turning many products into commodities.

- Extreme Margin Compression: With agents instantly comparing every available option across the entire internet, price becomes a dominant factor. This will lead to intense, real-time price competition, squeezing profit margins for merchants who cannot differentiate on other data-driven metrics like quality or delivery speed.

- The "Winner-Take-All" Agent: The network effects are so strong that a few "Prime Agents" will likely dominate the market, creating new monopolies that could stifle competition and innovation if not properly regulated.

3. Social & Regulatory Challenges: The Unwritten Rules The technology is moving faster than our legal and social frameworks can keep up, creating a host of complex new questions.

- Algorithmic Bias: LLMs are trained on human-generated data, which is rife with biases. An agent could perpetuate these biases, for example, by recommending products or services differently based on a user's demographics, even if unintentional.

- Data Privacy vs. Personalization: For an agent to be effective, it needs deep access to a user's personal data—their location, calendar, communications, and purchase history. Protecting this data while still allowing for hyper-personalization is a monumental challenge.

- Accountability and Liability: Who is responsible when an agent makes a mistake? If an agent books the wrong flight or buys a faulty product, is the fault with the user who set the goal, the developer who built the agent, the network that processed the transaction, or the merchant who sold the goods? Our legal system has no clear answers yet.

The Path Forward: A Blueprint for a Trusted Ecosystem

Navigating these risks is not impossible, but it requires a conscious and collaborative effort from day one. The path forward rests on three pillars:

- Develop Open Technical Standards: The most urgent need is for cross-industry collaboration on the foundational protocols for agentic commerce. This includes creating a universal standard for agent identity, secure tokenization, and the cryptographic proof-of-delegation needed to ensure every transaction is verifiable and non-repudiable.

- Build for Radical Transparency and User Control: The only way to build consumer trust is to make the system fully transparent. Users must have a clear, easily understandable view of how their agents make decisions and a simple, powerful set of tools to control and revoke permissions at any time. "Black box" agents will fail.

- Engage Proactively with Regulators: The industry cannot wait for regulations to be imposed upon it. Stakeholders—from tech giants to banks to merchants—must come together to proactively engage with policymakers, helping them understand the technology, identify potential harms, and co-author intelligent, flexible regulations that protect consumers without stifling innovation.

Conclusion: The World in 2030 is Delegated

Imagine a morning in 2030. Anna, a small business owner, wakes up not to an alarm but to a gentle notification from her personal agent. "Good morning, Anna. Your 9 AM meeting has been pushed to 9:30. I've already adjusted your travel time. Also, your business agent has flagged an issue: a typhoon in the South China Sea will delay your usual shipment of components by 72 hours. It has already sourced the same components from an alternate supplier in Mexico, negotiated a price match, and confirmed they will arrive on schedule. The production line has been automatically adjusted. No customer impact is expected. Would you like a summary of the agent's actions?"

The present situation is not a scene from science fiction. This represents the logical culmination of agentic commerce. It is a world where complex logistics, personal planning, and commercial transactions are handled autonomously in the background, guided by our goals and governed by our trust. It is a world where the primary measure of efficiency is not how quickly we can complete a task, but how effectively we can delegate an outcome.

The journey from today's tentative chatbots to tomorrow's fully autonomous agents is more than a technological evolution; it is a psychological one. We are being asked to shift our mindset from being hands-on managers of digital tasks to becoming high-level directors of digital outcomes. The friction in our lives today is not the inability to buy things online; it is the cognitive load of managing the dozen apps, websites, and decisions required to solve a single, complex problem.

The companies that will lead this next economic era will be the ones that understand this fundamental shift. They will be the ones who build the tools of delegation and the platforms of trust. They will be the banks that secure our agents, the networks that orchestrate their interactions, the merchants that provide them with verifiable truth, and the tech companies that make them intuitive and reliable. They will not just be participants in the "Do It Now" economy; they will be its architects.